CapPlace is an international brokerage platform offering access to over 200 trading instruments, from forex and stocks to cryptocurrencies and commodities. The company advertises leverage of up to 1:200, personalized analytics, and a bonus program for active clients. The trading conditions are tailored to suit traders of various experience levels. And what exactly lies behind this name? How safe is it to trade here in reality? Let us examine the facts.

We begin with CapPlace’s official website. It features a modern and tidy design — the main banner displays vibrant visuals, including business professionals and trading elements, immediately creating a productive atmosphere.

The main menu is divided into three key sections: Trading, Company, and Support. The Trading section contains information on the available assets (forex, commodities, cryptocurrencies, and other instruments), leverage, and platform capabilities. The Company section includes basic legal documents, terms of service, and details about the company itself. The Support section provides contact information.

CapPlace’s website is available in three languages: English, Japanese, and Hindi, underlining the project’s global ambitions. At the same time, the footer clearly states that the company does not provide services to residents of certain countries, including Japan, the United States, and Canada — a standard legal disclaimer used by many international brokers.

CapPlace offers several convenient methods of communication with its managers. Firstly, users can contact support via email or telephone. Two numbers are listed on the site: an international line, +815031264259, and a UK number, +447458196365.

There is also a contact form — simply fill in a few fields, and a manager will get in touch directly. Additionally, a live chat feature is available in the bottom right corner — it activates quickly and allows users to ask questions in real time.

The company support team responds clearly, concisely, and fairly quickly — typically within a few minutes. It is particularly convenient that communication is accessible both via mobile devices and desktops, making it as easy as possible to get in touch with the broker.

The trading conditions at CapPlace are suitable for both beginners and more experienced traders. The minimum deposit is $250 — a reasonable entry threshold for those seeking access to a full-fledged platform offering a wide range of instruments and professional support. For instance, at this level, users gain access to market operations involving currencies, commodities, stocks, indices, cryptocurrencies, and precious metals.

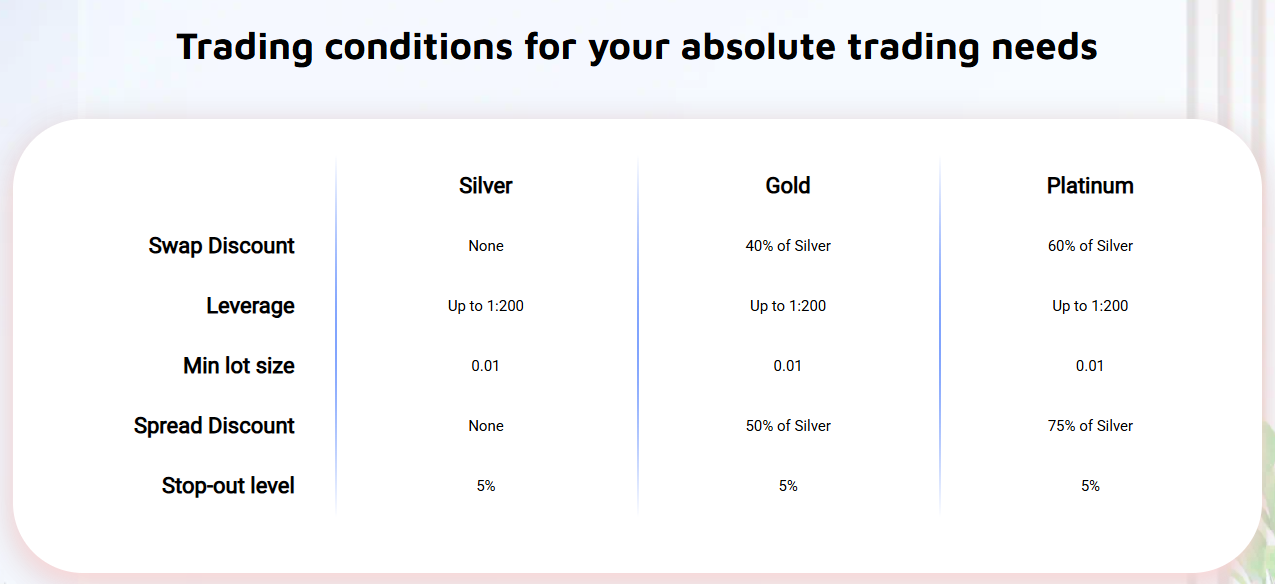

CapPlace offers three account types: Silver, Gold, and Platinum. The conditions improve as the account level increases — commissions are reduced, there are discounts on spreads and swaps, and additional features and priority support are provided. For example, the Gold account offers a 50% discount on spreads, while the Platinum account offers a 75% discount. The minimum trade size starts from 0.01 lots, and leverage is available up to 1:200, allowing for flexible risk and capital management. However, it is important to remember the risks associated with margin trading.

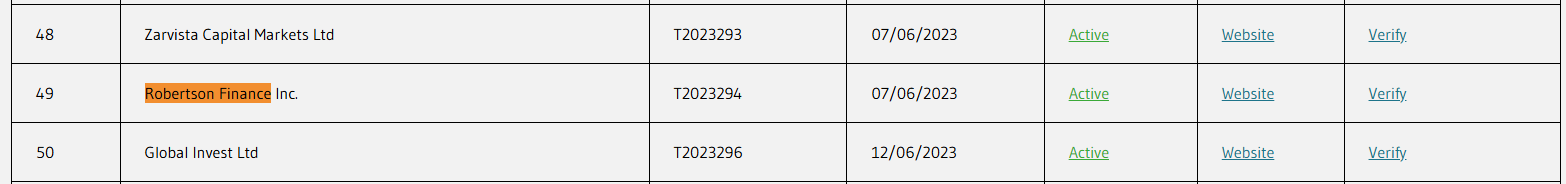

The broker operates on a legal basis. The company is owned by the legal entity Robertson Finance Inc., registered in the Comoros. All relevant information is available on the company’s official website, including the registration number and license. This is a significant advantage, when a broker publicly discloses such details, it reflects transparency and a lack of intent to conceal anything.

Further confirmation of its legitimacy is the regulation by MISA, the governmental financial authority operating in the Comoros. Obtaining a license indicates that CapPlace has undergone registration, submitted the necessary documentation, committed to following specific standards, and is under regulatory supervision.

CapPlace also adheres to the Know Your Customer (KYC) policy. To fully cooperate with the platform, users are required to verify their identity by submitting documents confirming both their identity and residential address. This is an important indicator, as fraudulent platforms typically allow anonymous accounts, whereas legitimate and reputable companies always require client identification.

It is also worth noting that the website features an official warning about the risks of trading CFDs and forex instruments. CapPlace clearly states that margin trading carries high risks and may lead to capital losses. This demonstrates that the company does not create false expectations and honestly informs clients of potential risks, in accordance with international standards of financial ethics.

Online reviews of CapPlace are predominantly positive. Users praise the platform’s user-friendly interface, favorable conditions, and responsive customer service. Many highlight that the conditions are indeed as advertised: order execution is swift, the platform is stable, and withdrawals are processed without delays.

The company is suitable for all categories of traders, both beginners and experienced professionals. It operates under the supervision of a financial commission, which means it can offer safety guarantees. CapPlace provides an opportunity to trade profitably and earn on the Forex/CFD markets.

Helen always knew that her passion for journalism was more than just a hobby. It was a potential career. She began her professional journey at a local newspaper in the small town where she was born. Writing on a variety of topics, from local news to financial reviews, her persistence and investigative talent soon caught the attention of editors at larger publications. We are thrilled that Helen accepted our offer and now writes for fincapital-reviews. Her exposés always create a buzz. Sometimes, we think Helen could easily open her own detective agency.

I am not a particularly experienced trader, so I have only recently started trading with this broker, but the impressions so far are positive, and the experience has been good. The platform is user-friendly, everything is intuitive, and there are plenty of assets to choose from. I made one withdrawal, and the funds arrived the same day I submitted the request. Support is responsive and quick to reply. So far, everything is stable – I continue to trade

I have nothing negative to say about the firm. The company is impressive and conducts itself fairly towards traders. Execution is instant, under 1 millisecond, with spreads no greater than 2–3 points. The terminal operates flawlessly, with no glitches or slippage. I am pleased and have no regrets about choosing this firm. Additionally, they hold a MISA licence

I traded through CapPlace for about two months and was generally satisfied. The platform runs smoothly, trades are executed quickly, and I did not notice any delays or slippage. What impressed me most was that the support team genuinely responds. I used the live chat and received a clear reply within a couple of minutes. I also appreciated the variety of available assets – I trade both currencies and stocks, and everything is conveniently available in one place. I withdrew funds twice – $1,000 each time – once to a card, and the second time via bank transfer, and both transactions went smoothly. The verification process was quick, and only the necessary documents were requested. Overall, for those looking for a straightforward and functional platform, this is a perfectly reasonable option!

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don’t look even slightly believable.